On August 11, 2025, RumbleOn, Inc. (NASDAQ: RMBL) announced results for the second quarter ended June 30, 2025… pretty standard operating procedure. But by Wednesday, RMBL’s stock ticker was gone, HQ was relocated and RideNow had transformed its operations from the “Omnichannel” back to its roots of being a retailer. Shareholders were informed that, “Rebranding of the Company’s name to RideNow Group, Inc. (“RideNow”), aligning it back with the Company’s roots of being a leading powersports dealership group and returning the corporate headquarters back to the Company’s original RideNow flagship store location in Chandler, AZ, each effective August 13, 2025.”

Changing the Company’s ticker symbol from “RMBL” to “RDNW” on The Nasdaq Capital Market, effective August 13, 2025 requires no action by existing stockholders with respect to the name and ticker symbol changes, according to the quarterly statement. “Shares of the Company’s Class B Common Stock currently trading on NASDAQ under the ticker symbol “RMBL” will automatically commence trading under the new ticker symbol as of the market open on August 13, 2025.”

Closing the books on RumbleOn — which saw a Q2 decline of 11% and a net loss of $32.2 million, Michael Quartieri, Chairman, Chief Executive Officer and Interim Chief Financial Officer, stated: “I am pleased to report that we are making good progress and our operating results improved over the course of the second quarter. While performance in the second quarter was nowhere close to where we want and expect to be, the Company’s ‘back to our roots’ strategy is working and driving improvement in our year-over-year results.

“We are improving our execution every day and have a very clear road map of work to do to continue to drive improvements and meaningful growth in the business. In addition, the successful closing of the term loan amendment provides us with operating flexibility to execute upon our strategy. I am as confident as ever that our current actions will lead to significantly improved results and shareholder value,” claims Quartieri.

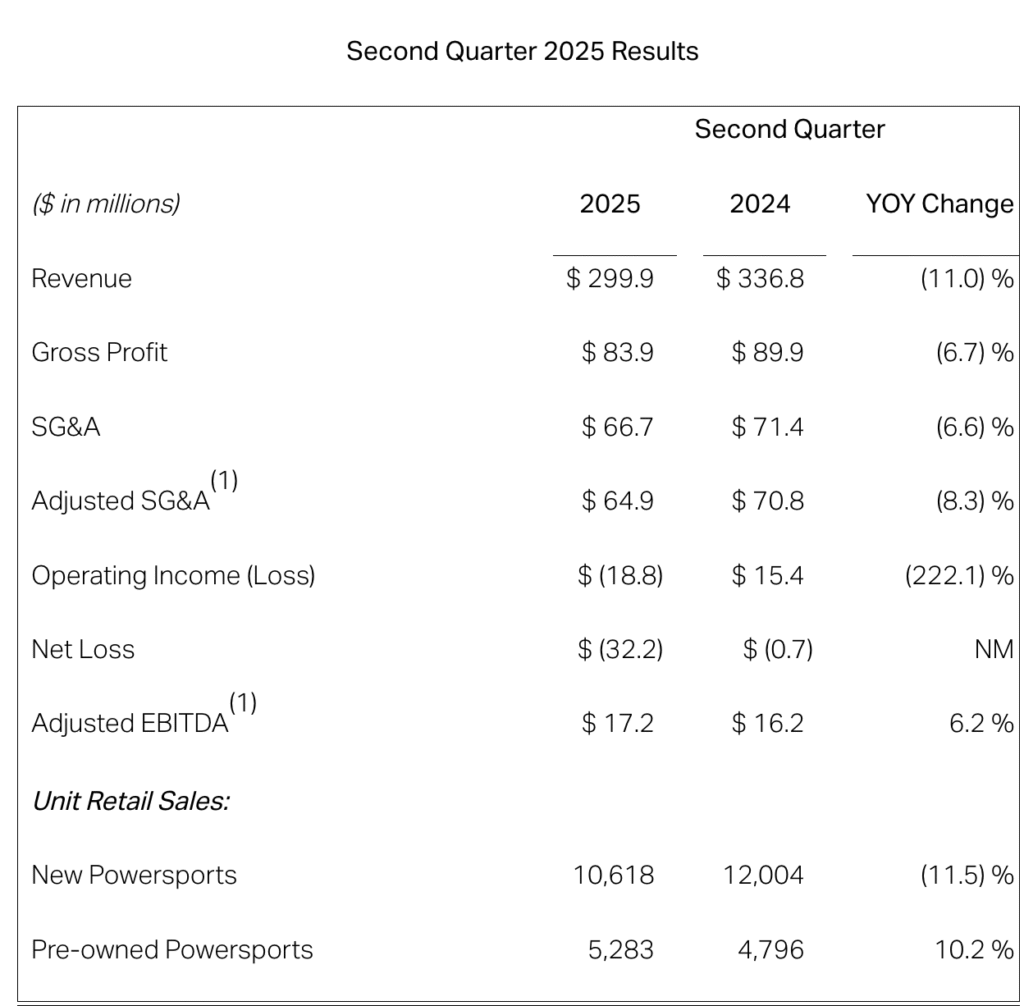

CHART 1

Key Second Quarter 2025 Highlights (Compared To Second Quarter 2024):

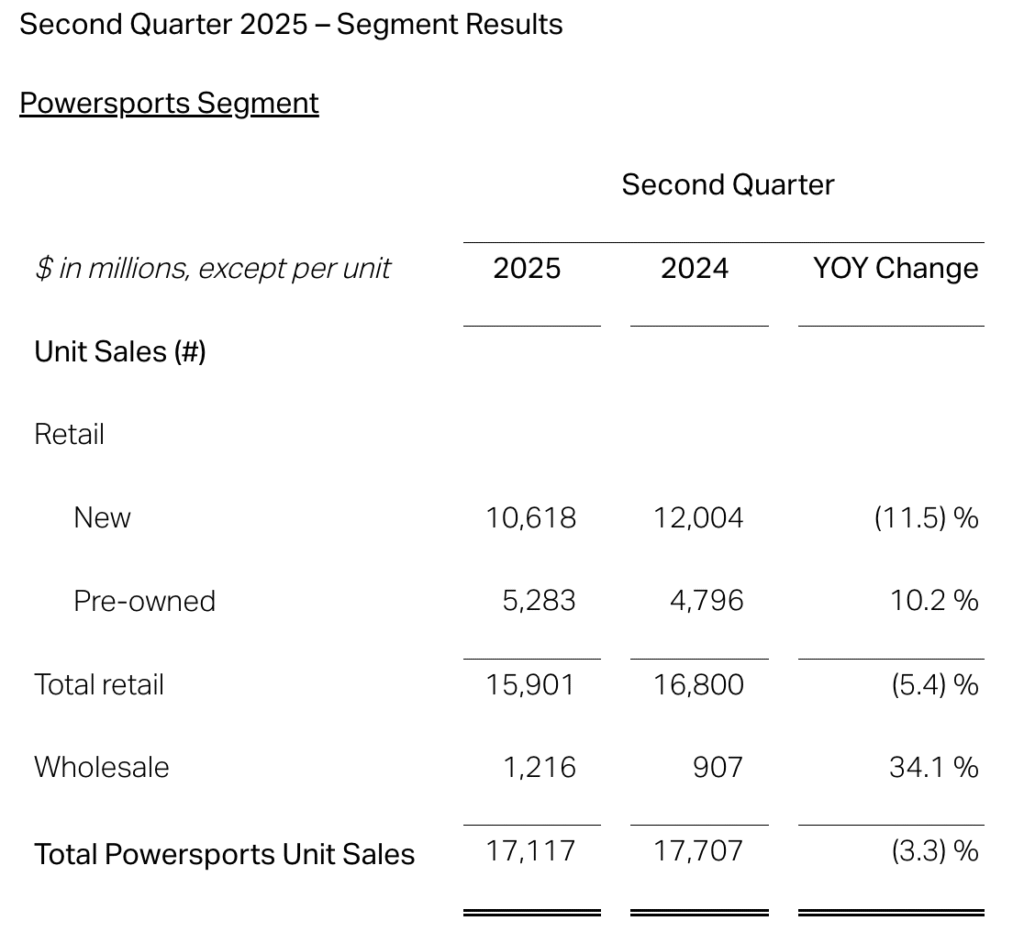

• Revenue of $299.9 million decreased 11.0%, driven by a 590 decline in unit sales in the Company’s powersports segment and a $13.9 million decline in revenue in the vehicle transportation services segment

• Net loss, which included impairment charge of $34.0 million related to franchise rights, was $32.2 million compared to $0.7 million

• Selling, general & administrative expense (SG&A) was $66.7 million, a $4.7 million reduction compared to $71.4 million

• Adjusted EBITDA increased $1.0 million to $17.2 million compared to $16.2 million

CHART 2

The Company ended the quarter with $59.8 million in total cash, inclusive of restricted cash, and $185.1 million of non-vehicle net debt. Availability under the Company’s powersports short-term revolving floor plan lines of credit totaled approximately $125.9 million as of June 30, 2025. Total Available Liquidity, defined as total cash plus availability under floorplan credit facilities, was $185.7 million as of June 30, 2025. Cash inflows from operating activities were $4.0 million for the first half of 2025, compared to $29.2 million for the same period in 2024. Cash flow from operations in 2024 benefited from the proceeds from the sale of the Company’s loans receivable portfolio.

On August 10, 2025, the Company entered into an agreement with its lenders to extend the maturity date of its term debt credit agreement to September 30, 2027, at a 50-basis point reduction in interest, with revised financial covenants and other requirements. In connection with this amendment and extension, the Company will pay down $20.0 million in principle on the term debt, funded from proceeds of a $10.0 million subordinated note from certain related parties and existing cash balances. Following the paydown of the principal balance, cash payments for other interests are expected to be $3.4 million lower on an annualized basis.