Noting positive headway despite a 12% decrease in revenue, RumbleOn, the largest powersports retail group in the nation, released its Q2 numbers. “Operating cash flows for the first half of 2024 totaled $29.2 million compared to $(5.6) million in 2023,” claims CEO Mike Kennedy. “Free Cash Flow for the first half of 2024 was $28.2 million compared to $(11.6) million in the 2023 period as the company reduced Non-Vehicle Net Debt by $33.8 million in the first half of 2024.”

Other highlights from the first half of 2024 include:

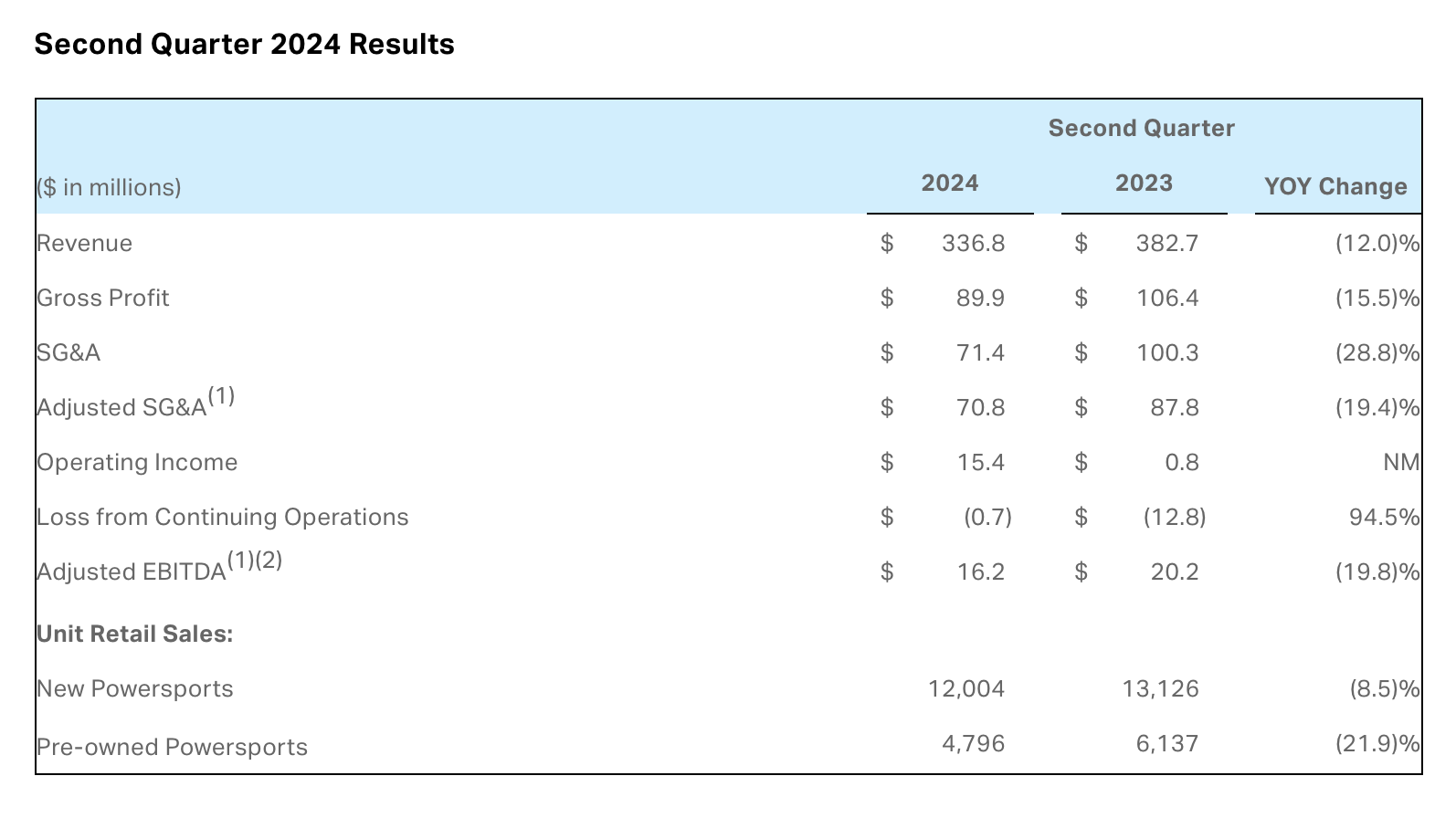

• Revenue of $336.8 million decreased 12.0%

• Net loss totaled $0.7 million compared to net loss of $13.6 million

• Selling, general & administrative expense (SG&A) was $71.4 million compared to $100.3 million. Adjusted • SG&A decreased 19.4% to $70.8 million, or 78.7% of gross profit (GP), from $87.8 million, or 82.5% of GP

• Adjusted EBITDA of $16.2 million decreased 19.8%

Kennedy attributes the newly mapped out Vision for the turn-around. “We executed the initial phase of Vision 2026 strategy to run the best dealerships in America, which is expected to yield $30 million of annualized savings. To that end, RumbleOn opened RideNow Powersports Houston, a dedicated pre-owned vehicle dealership, in June.

"Our second quarter performance reflects the strength of our powersports dealership group as we continue to progress on our turnaround. It is a challenging time for the powersports industry, as we navigate a high interest environment, a cautious consumer, and inflated new major unit inventories. Despite these challenges, I'm proud of the way our team has responded.

“The team's efforts delivered positive free cash flow during the first half of 2024, and we expect to continue to deliver positive free cash flow in the back half of 2024,” concludes Kennedy. “We remain laser focused on achieving our Vision 2026 goals and creating per-share value.”