LIVEWIRE LOSSES CONTINUE IN Q2, STILL #1 EV MOTORCYCLE RETAILER

“During the second quarter, we continued our focus on what can be controlled, reducing consolidated operating loss by 35% compared to the prior-year same quarter,” claimed LiveWire CEO Karim Donnez, CEO. Despite headcount reduction and other cost-cutting measures, the Company’s consolidated net loss was $18.8 million for the second quarter 2025, compared to $24.8 million in the same period prior year, offset by a decrease of $2.7 million of non-operating income related to the change in fair value of the outstanding warrants as of June 30, 2025 and a decrease of $1.3 million in interest income as compared to prior year.

Second Quarter Highlights & Financial Results

• Consolidated operating loss decreased by $9.9 million from the same quarter 2024 primarily driven by a decrease in consolidated selling, administrative and engineering expenses.

• Reduced consolidated selling, administrative and engineering expense by $7.6 million from same quarter 2024 due to initiatives taken in the later half of 2024 to streamline headcount and reduce other costs.

• Reduced net cash used during the first half of 2025 by $19.8 million or 36%, versus the same period in 2024.

• Entered Norway as a new market and continued to contract with additional dealers in existing markets in Europe.

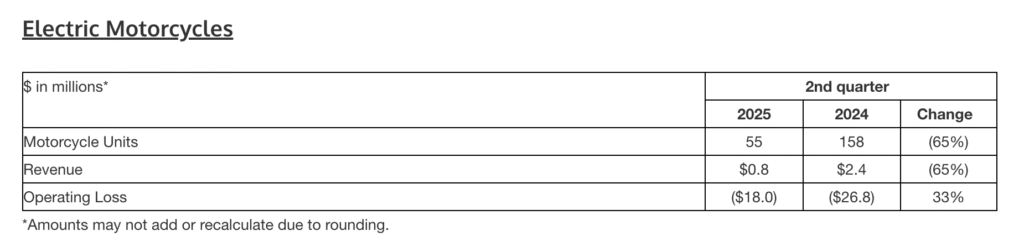

“Despite continued supply chain challenges driven by the overall economic market, STACYC delivered a 25% increase in revenue compared to the prior-year same quarter,” he added. For the bigger eBikes LiveWire is #1 with 55 units sold globally in Q2. “While Electric Motorcycle revenue decreased compared to the prior-year same quarter in the challenging EV market, we remained the #1 electric motorcycle retailer in the US 50+ horsepower on road EV segment.”

The plan is to charge ahead starting in Q3. “We are thrilled with the positive feedback we have received on the two prototype models that were on display at the Harley-Davidson Homecoming and look forward to sharing additional details on these lower-priced, smaller models in the upcoming weeks and months,” said Donnez.

Bottom line: On May 1, 2025, due to the uncertain global tariff situation and overall macroeconomic conditions, we withdrew our full year 2025 financial outlook that had been provided on February 5, 2025. Given that the global tariff and business outlook especially for discretionary product purchases remains uncertain, we continue to withhold our full year HDMC 2025 financial outlook. For LiveWire, we are updating our previously issued guidance related to Operating Loss to $59-$69 million and a total cash use of $50-$60 million.