BRP published its financial results for the first quarter of 2025, and to no surprise, the numbers were flat. “The first quarter of Fiscal 2026 was marked by continued softer consumer demand exacerbated by the uncertainty surrounding changes to global tariffs and trade regulations,” BRP announced on May 29. As the Company continued to focus on reducing network inventory levels on Seasonal Products and managed industry slowdown on Year-Round Products, the volume of shipments and revenues decreased compared to last year.

“We delivered a sound first-quarter performance despite the current context, with results in line with expectations,” explains outbound President/CEO José Boisjoli. “Driven by a solid end-of-season in Snowmobile, we slightly outperformed the North American powersports industry with retail sales holding steady compared to Q1 last year,” he said.

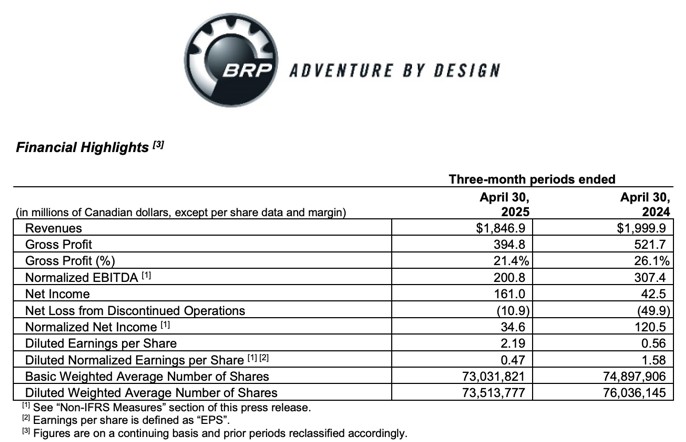

The decrease in the volume of shipments, the higher sales programs due to the sustained promotional environment and the decreased leverage of fixed costs have led to a decrease in the gross profit and gross profit margin compared to the same period last year. This decrease was partially offset by production efficiencies and a late season surge in snowmobiles.

Revenues decreased by $153.0 million, or 7.7%, to $1,846.9 million for the three-month period ended April 30, 2025, compared to $1,999.9 million for the corresponding period ended April 30, 2024. The decrease in revenues was primarily due to a lower volume sold across most product lines, as a result of the industry’s slowdown in Year-Round Products and continued focus on reducing network inventory levels in Seasonal Products. The decrease was also due to higher sales programs across most product lines. The decrease was partially offset by favorable pricing across most product lines. The decrease includes a favorable foreign exchange rate variation of $33 million.

“Looking ahead, given the uncertainty, we are still refraining from making financial projections at this time. In the short-term, although demand remains soft due to a challenging macro environment, our strong product portfolio and leaner inventory levels position us favorably for a rebound,” claims Boisjoli, who said he is staying onboard with BRP for the fiscal year. “Over the longer term, our decision to double down on our core powersports activities, combined with our team’s ingenuity and our commitment to pushing technology and innovation, provide the foundations for sustained leadership.”