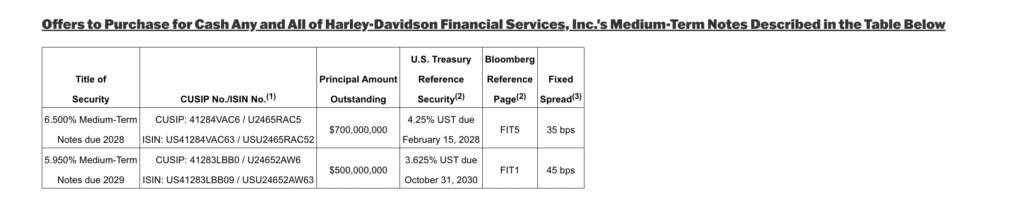

Led by J.P. Morgan Securities LLC, TD Securities (USA) LLC and Wells Fargo Securities, LLC — with Barclays Capital Inc. and U.S. Bancorp Investments, Inc. as co-dealer managers — Harley-Davidson Financial Services, Inc. announced the commencement of tender offers to purchase for cash any and all of the Medium-Term Notes issued by The Motor Company. These tender offers (the “Offers”) are being made pursuant to the Offer to Purchase, dated November 17, 2025.

Act fast, though! The offers will expire at 5:00 p.m., New York City time, on November 21, 2025, unless extended or terminated at the sole discretion of HDFS. Tendered Notes may be withdrawn at or prior to the Expiration Date by following the procedures in the Offer to Purchase, but may not thereafter be validly withdrawn, unless otherwise required by applicable law.

“We expect to purchase all Notes that have been validly tendered and not validly withdrawn at or prior to the Expiration Date and accepted for purchase pursuant to the Guaranteed Delivery Procedures,” adds HDFS. “Subject to all conditions to the Offers having been satisfied or waived by us, on the third business day after the Expiration Date, which is expected to be November 26, 2025, unless extended.”