As Dr. Paul Leinberger notes in the next issue, all purchase decisions are a combination of rational factors and emotions. Given Monday’s stock crash, emotions are running high and irrational moves are being made! But is this the day the inevitable downturn begins or is there more in the works? Dr. Leinberger calls it like he sees it:

“Economists have long known that “irrational” emotions (“irrational” because economists hate the fact that human beings allow emotions to factor into decision processes) play an important role in any purchase decision. The more important the decision, the more emotions tend to play a role. “That’s a great deal on that bike, but do you love it?”

Even more important is the role emotions play on expectations. Emotions cause spending booms, extend spending busts, and trigger “irrational” buying behavior. Remember the great toilet paper shortage in the early days of the pandemic? It wasn’t rational to think that grocery stores were going to run out of toilet paper, but what if? Emotions took over and sure enough, grocery stores ran out of toilet paper. Emotions trigger self-fulfilling prophecies and because of that, they need to be carefully considered when thinking about the future.

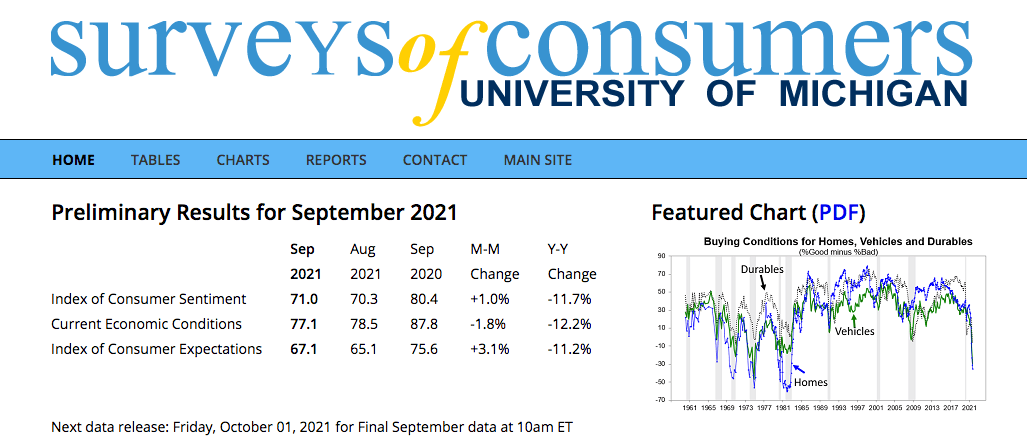

Consider what happened to consumer confidence in August. It fell off a cliff! The University of Michigan’s closely watched gauge of consumer sentiment plunged to 70.2 in August from a July reading of 81.2. That’s lower that at any time during the pandemic and the lowest reading since December 2011. To put it in perspective, there have been only six times in the history of the survey (which began in 1978) that the reading has dropped so precipitously. The losses were widespread across demographic groups, regions, and for all aspects of the economy…

Want to know more? You will have to check out the full column in Dealernews!