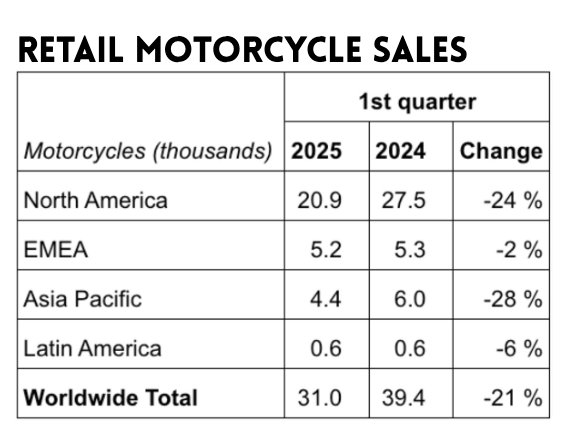

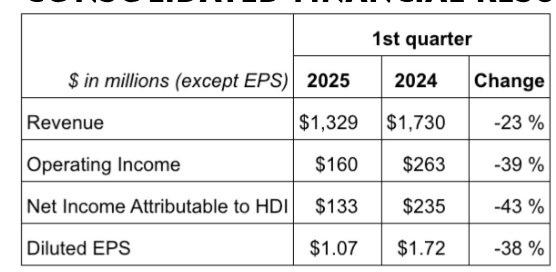

While H Partners and The Motor Company continue to exchange jabs in advance of the vote, the Quarterly Financials paint a pretty clear picture of what the world outside the Board Room is witnessing. No matter how you spin it, the bottom line is a 51% decline in HDMC Operating Income. Harley’s global retail motorcycle sales in the first quarter were down 21% versus the prior year.

“Our first quarter results were ahead of our expectations in many areas, while retail sales in the U.S. came in softer than anticipated” explains Jochen Zeitz, Chairman, President and CEO, Harley-Davidson. “We remain focused on navigating the challenging economic and tariff environment, through diligent execution of our cost productivity measures, supply chain mitigation, tight operating expense control and reducing dealer inventory. In addition, we remain committed to driving retail sales through increased marketing initiatives as we enter the riding season.”

First Quarter 2025 Highlights

• Delivered diluted EPS of $1.07

• HDMC operating income margin of 10.8%

• HDFS operating income margin of 26.1%

• Global motorcycle retail sales down 21% year-over-year

• HDMC revenue down 27% year-over-year, primarily due to a planned decrease in motorcycle shipments

• Repurchased $87 million of shares (3.4 million shares)

First quarter global motorcycle shipments decreased 33%, which was mostly expected but also reflects the softer than expected demand environment. Revenue was down 27% driven primarily by the planned decrease in wholesale shipments and unfavorable foreign currency, partially offset by favorable mix and favorable global pricing and net incentives. Parts & Accessories revenue was down 14% and Apparel revenue was down 11%, due to lower customer traffic at dealer stores.

We held the May issue one day to include the first quarter 2025 “highlights” to provide a little context to the proxy battle: