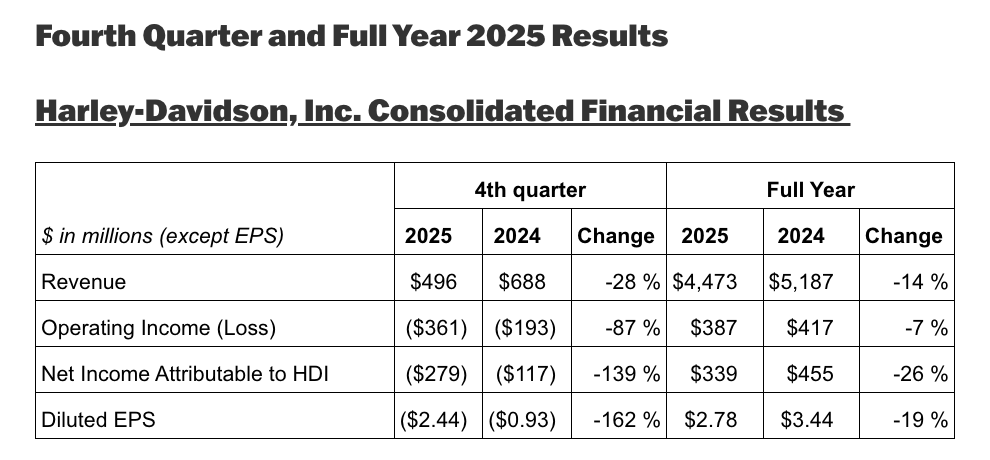

Harley-Davidson closed Q4 down 28% in consolidated revenue, driven by a 10% revenue decline at HDMC and a revenue decline of 59% at HDFS. The consolidated operating loss was $361 million in Q4, compared to a consolidated operating loss of $193 million in the prior year period. This decline was mirrored by the full year financials: Consolidated revenue was down 14% compared to prior year. This was driven by a 13% decrease at HDMC and a 16% decrease at HDFS. For the full year, consolidated operating income was down 7%, driven by a loss at HDMC and record-high earnings at HDFS. HDFS’s results were favorably impacted by the HDFS transaction. Meanwhile, the full year operating loss at LiveWire was $75 million, which was in-line with expectations.

“As we close out a challenging year for The Motor Company, we are taking deliberate actions to stabilize the business, restore dealer confidence, and align wholesale activity with retail demand,” stated Artie Starrs, President and CEO, Harley-Davidson. “While near-term results reflect these actions, the progress we are seeing reinforces our confidence in the reset underway and our ability to rebuild Harley-Davidson’s long-term earnings and cash-flow power,” Starrs added. “With an iconic brand, a deeply loyal rider community, and a dealer network unlike any other, we believe Harley-Davidson is well positioned as we chart a clear path forward.”

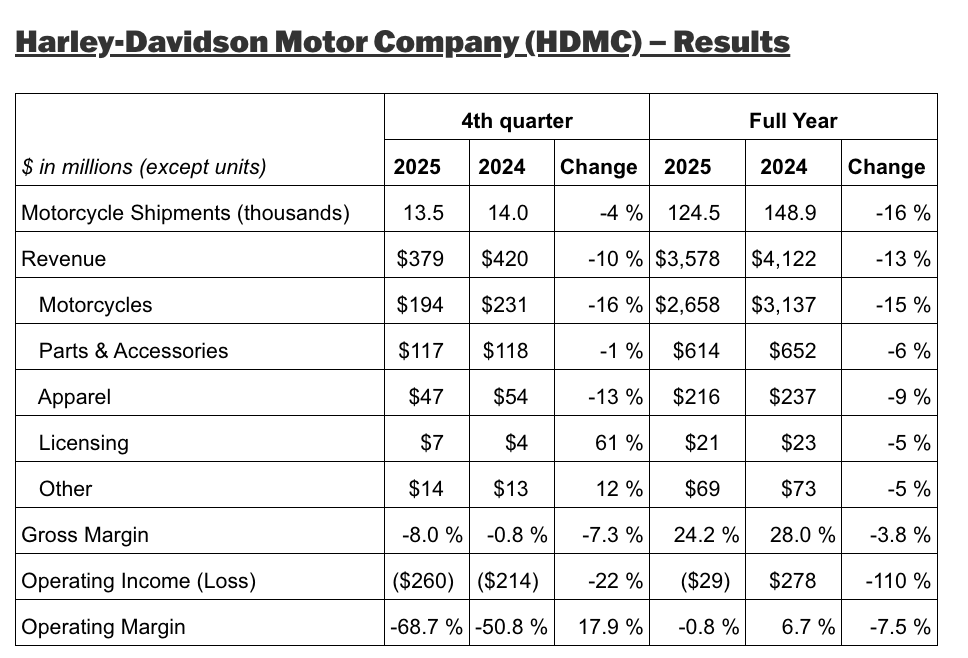

In the fourth quarter, global motorcycle shipments at HDMC decreased 4% from a year ago. HDMC revenue was down 10%, due to net pricing and incentive spend and lower volumes. Gross profit came in at a loss of $30 million compared to a loss of $3 million in the prior year period, due to increased tariff costs and net pricing and incentive spend. Operating expenses totaled $230 million, which was $19 million higher compared to prior year, primarily due to higher marketing expense. Operating loss was $260 million in the fourth quarter compared to an operating loss of $214 million in the prior year period.

For the full year, global motorcycle shipments decreased 16% from the prior year. HDMC revenue was down 13%, due primarily to lower wholesale volumes. Gross margin was lower by 3.8 points in 2025 compared to 2024, driven by incremental tariffs, negative operating leverage and lower volumes. Operating expenses were $895 million, $18 million higher than a year ago. Operating loss was $29 million for the full year 2025 compared to operating income of $278 million in the prior year.

2025 Full Year Low Lights & Results

• Global dealer inventory levels of new motorcycles finished the year down 17% vs. end of Q4 ’24

• Global retail motorcycle sales of 132,535 units, down 12% from prior year

• HDMC global motorcycle shipments of 124,477, down 16% from prior year

• HDMC operating loss of $29 million

• Returned $434 million of capital to shareholders via $347 million of discretionary share repurchases and $86 million of dividends paid

2026 Financial Outlook

For the full year 2026, the Company expects*:

• HDMC global motorcycle retail sales of 130,000 to 135,000 units

• HDMC global motorcycle wholesale shipments of 130,000 to 135,000 units

• HDMC operating income of a $40 million loss to a $10 million profit

• HDFS operating income of $45 to $60 million

• LiveWire operating loss of $70 to $80 million

• Harley-Davidson, Inc. capital investments of $175 to $200 million

*These figures may be impacted by the new strategic plan expected to be announced in May 2026