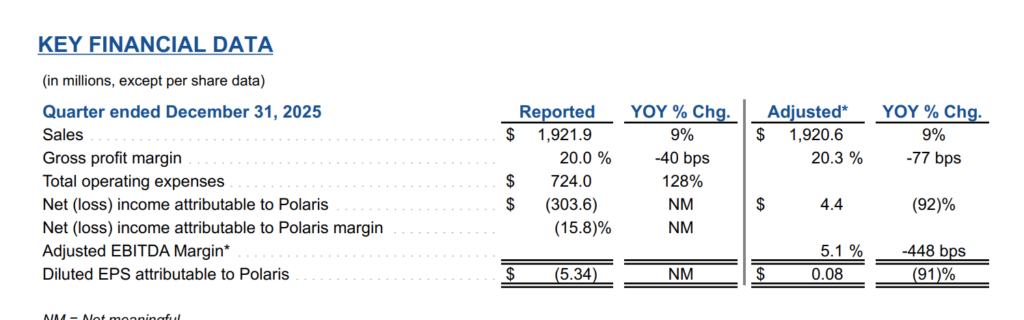

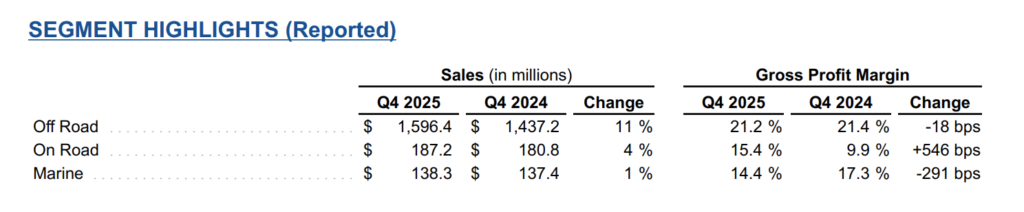

Polaris Inc. (NYSE: PII) (the “Company”) has released Q4 and full year 2025 results. For the fourth quarter, the Company reported worldwide sales of $1,922 million, up 9% compared to Q4 of 2024. North America sales of $1,623 million represented 84% of total company sales and increased 10% from $1,481 million in 2024. Operating expenses were $724 million in the fourth quarter of 2025 compared to $318 million in the fourth quarter of 2024 primarily due to charges associated with the Indian Motorcycle business held for sale, the majority of which were non-cash charges. Operating expenses as a percentage of sales were 37.7%.

According to CEO Mike Speetzen, “2025 may have brought headwinds outside our control, but the Polaris team met the year with resolve, a disciplined focus and unwavering commitment to our dealers and riders. We delivered strong results for the year, gaining share across our segments, enhancing operations, achieving healthy dealer inventory levels and advancing strategies that strengthen our foundation.”

Cost cutting, including the closure of the Osceola powertrain facility and sell off of Indian motorcycles should be positive for Polaris. The company expects 2026 sales to be up 1% to 3% versus 2025. The Company expects adjusted diluted EPS attributed to Polaris Inc. common stockholders to be between $1.50 and $1.60, relative to ($0.01) in 2025.

“Our long-term growth plan remains anchored in category-defining innovation, efficient operations, and a best-in-class dealer network,” Speetzen concluded. “We believe these priorities position us to lead the industry, drive profitable growth and deliver strong returns for shareholders.”