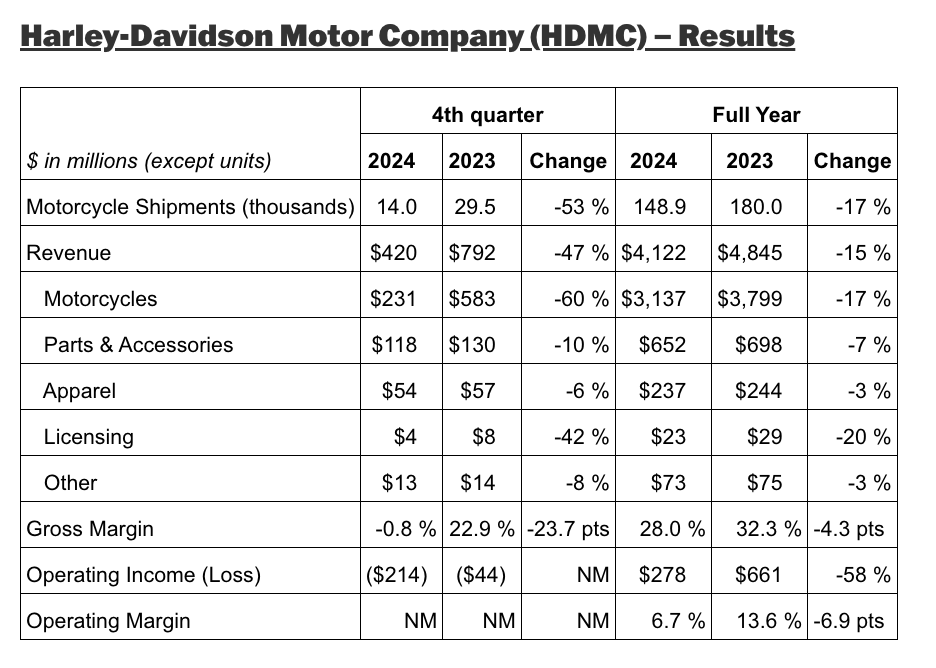

Harley-Davidson lost money in 2024, according to the Q4 financials: HDMC revenue of $420 million, down 47% vs. prior year. “In 2024, we saw our performance being significantly impacted by the continued cyclical headwinds for discretionary products, including the high-interest rate environment affecting consumer confidence,” is how Jochen Zeitz, Chairman, President and CEO, Harley-Davidson addressed the elephant in the room.

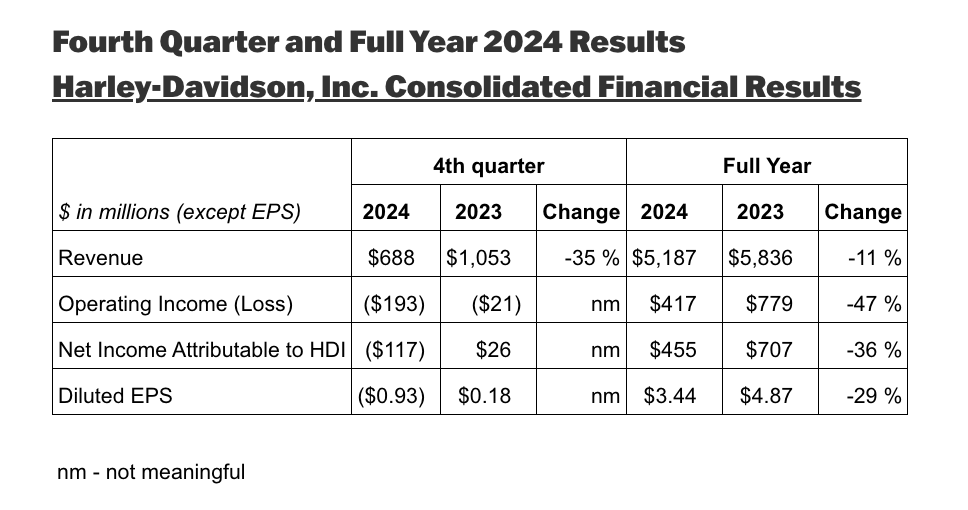

The Q4 numbers indicate fourth quarter consolidated revenue was down 35%, driven by a revenue decline of 47% at HDMC. This was partially offset by revenue growth of 4% at HDFS. In the fourth quarter, the consolidated operating loss was $193 million which compares to an operating loss of $21 million in the prior year’s period.

For the full year, consolidated revenue was down 11% compared to the prior year. This was driven by revenue decreases of 15% at HDMC and by $12 million at LiveWire, partially offset by a revenue increase of 9% at HDFS. For the full year, consolidated operating income was down 47% compared to last year. This was driven by an operating income decline of 58% at HDMC, partially offset by a 6% increase at HDFS. The full year operating loss at LiveWire was $110 million, which was in-line with expectations.

THE SILVER LINING?

“The launch of our new Street Glide and Road Glide touring motorcycles contributed to nearly 5% growth in the U.S. Touring segment and drove H-D’s market share to 74.5% in ’24,” notes Zeitz. “The decisions we have made and the bold actions we have taken as part of our Hardwire strategy are continuing to strengthen our foundation for the future.”

For the full year 2025, The Motor Company expects:

• HDMC: revenue flat to down 5% and operating income margin of 7.0% to 8.0%

• HDFS: operating income down 10% to 15%

• LiveWire: electric motorcycle unit sales of 1,000 – 1,500 and an operating loss of $70 to $80 million

• Harley-Davidson, Inc. diluted earnings per share flat to down 5%

• Harley-Davidson, Inc: capital investments of $225 to $250 million

“The industry has faced many challenges over the past couple of years, impacting at all levels, but we believe we are best positioned to take advantage of any uptick in consumption,” claims Zeitz.